IT and the changing face of pharmacy practice

In Analysis

Follow this topic

Bookmark

Record learning outcomes

Information technology has proved to be a great enabler during the coronavirus pandemic. Now the falling cost of robotics and the use of ‘big data’ looks set to change the face of pharmacy practice.

Can machine learning and artificial intelligence safely do away with the need for a pharmacist to do a clinical check on every prescription? Will the falling costs of dispensing robots make hub and spoke an expensive white elephant for all but the largest operators? Has the pandemic led to de facto remote supervision?

These are all questions that have been posed by pharmacy IT providers over the past 12 months – and some of the answers may be coming sooner than you expect. Hub and spoke is back in the news, and at least one PMR supplier is looking to register its system with the MHRA as a medical device so that it can use machine learning and artificial intelligence to determine whether every prescription needs a pharmacist’s attention.

Bristol-based Invatech Health recently received a £900,000 award from the Government-funded Innovate UK to develop its Titan system. Since becoming EPS accredited in 2019, the first pharmacy system to do so for 15 years, Titan now has a 2 per cent share of the prescription market, processing over 1.5 million items a month, says chief executive Tariq Muhammad.

Titan’s cloud-based technology uses bar code scanning to help digitise workflow from end to end. “The majority of our pharmacies are now 100 per cent paperless – they don’t print out any tokens at all. That process was accelerated because of the Government exemption during Covid,” says Muhammad. “We have now reached a point where the pharmacist does not check the prescription at the end of the process – it is checked at the beginning.”

Much work has been done in the past 12 months to improve Titan’s reliability, speed and accessibility. Microsoft’s Power BI can be used to create reports, a ‘marketplace’ has been developed to encourage others to develop apps for the platform and, as with most other PMR providers, a CPCS module will be ready by September.

“We have been doing a lot of work with the BSA to get prescription payments reconciled in real time. We need to do better in reconciling the financials,” says Muhammad. “We have an end- to-end stock control management process and have created a process to eradicate splits. If a split pack is created during dispensing, the system creates a new bar code ID for it.

“Titan can access the NHS Spine via a secure VPN, which means you don’t need a N3 line. That has been a huge benefit with remote working. A pharmacist can work remotely while staff do the licking, sticking and packing – a game changer during Covid.” It also means a pharmacy can be set up with Titan within a week or so, with no lengthy wait for the installation of a N3 line.

Titan comes in two configurations, one for independents and the other an Enterprise option, which is more for specialist operators. The system is now installed in around 100 independents. “Independent pharmacies are our bread and butter,” says Muhammad, “but I do want the system to be out there with the innovators. We are setting up about 10 pharmacies a month in the independent sector and that will escalate towards the end of the year when Covid restrictions lift.”

The Enterprise option has attracted interest from online pharmacies and is now used by one of the largest. “Their system could not cope with the surge in prescription volume when the pandemic blew up. They chose to integrate with our system and from summer to mid-December last year secured a 400 per cent increase in prescription numbers,” says Muhammad. “It was a good win from the business point of view as it allowed us to prove that the system could cope.”

New from BD Rowa

The BD Rowa Smart and Vmax automated robots are the backbone of the company’s automated offering. Entering the market later this year will be BD Rowa Pickup, which is fully integrated with an in-pharmacy robot, and the Pickup Cloud, a standalone alternative.

The Pickup enables the collection of prescriptions and other items at a time that suits the customer, including out of hours. It will be available as an indoor or semi-outdoor unit.

Another key product for BD Rowa is the Vmotion interactive consultation and product demonstration screen. Interconnected with a BD Rowa robot, the screens can be used to display special offers, product advertising and pharmacy services, while offering the pharmacy full control over what is displayed.

Enter machine learning

Tariq Muhammad’s boldest move is yet to come – something he describes as a “significant development” but one he also recognises as being politically sensitive.

“What pharmacists do in terms of checking prescriptions is largely a waste of time,” he says. “We are using big data to create a form of machine learning that will predict what a pharmacist will do when they see a prescription. We have created a form of machine learning AI that will determine whether a prescription needs a pharmacist’s attention.”

He describes it as a significant step towards a clinical future for pharmacists without them losing control of the dispensing function.

MHRA approval is required for any applications of this nature, so Invatech is seeking to have Titan recognised as a medical device. Approval is expected this month [March] or April.

“I am also talking to the GPhC and starting to challenge for hearts and minds on this one. It is not as controversial as it might have been 10 years ago,” he says, adding that others are probably also looking into similar use of AI in pharmacy IT.

A pharmacist can work remotely while the staff do the licking, sticking and packing – a game changer during Covid

Tech jargon buster

Machine learning is the science of getting computers to learn automatically. With machine learning, computers can learn to make decisions and predictions without being directly programmed to do so. The process uses algorithms to build models that can then be applied to a task.

An algorithm is a set of instructions that a computer needs to follow to complete a particular task. In relation to machine learning, algorithms analyse input data to predict output values within an acceptable range. As these algorithms receive new data, they ‘learn’ to optimise their processes, meaning they improve performance and become more intelligent.

Artificial intelligence (AI) is a branch of computer science that focuses on developing computers and machines that can perform tasks that usually require human intelligence. AI systems often use real-time data and inputs to respond to situations and make decisions.

Consolidation and integration

Consolidation among IT providers has helped with integration. Last year’s acquisition of PharmOutcomes and subsequent integration with ProScript Connect meant that EMIS could provide an end-to-end solution for pharmacies delivering this season’s flu vaccination programme. And with pharmacies now taking a growing role in the Covid vaccination programme they, like many other vaccination centres, will be using EMIS’s Outcomes4Health to record vaccine administration.

“Community pharmacists’ workload has increased dramatically during the pandemic and, without changes to the current dispensing model, is in danger of becoming unsustainable,” says Sima Jassal, head of pharmacy at EMIS. This is one reason why the company is developing hub and spoke technology that will enable independents to check and dispense scripts remotely.

Technology will underpin many of the transitions envisaged in the new contractual framework, she says. “EMIS has already released pharmacy appointment booking capability to 10 million patients via Patient Access along with an integrated PGD offering.”

The theme of better integration and improved connectivity with other healthcare providers is picked up by Tracey Robertson, pharmacy product director at Cegedim. “We recently went live with a prescription tracker that integrates with the NHS Prescription Tracker service to provide fast and intuitive access from within the PMR. Next will be more integration with NHS systems with CPCS provision. We are also gearing up to integrate more into the wider ecosystem, with collection robots and delivery providers,” she says.

“We are looking to think more digitally for our customers. An example coming later in the year will be a new intelligent stock inventory management system. Stock wastage is high within the industry, and overstocking is a problem. The new IM system will help alleviate these issues by giving a real time view of what that pharmacy or group has at any one time.”

Pharmacy Manager, which Robertson describes as a “heritage application”, is getting a major overhaul. “We have taken the PMR solution [apart] bit by bit and been re-imagining it and rebuilding it. We are getting ready to launch our new Pharmacy Intelligence hub. It digitally connects head offices to store operations. It is a true cloud- based platform that gives a real time view of store activity and provides actionable intelligence.

“It is aimed at head offices, superintendents and buyers but it also offers independents flexibility if the owner wants to work remotely. We shared our plans for a hub and spoke solution with AIM last year. Our phase 1 solution should be ready soon.” Systems need to evolve to be more flexible and more modular, she says. As regards the NHS, there will be more integration. “Our relationship with the NHS has gone from strength to strength in the past 18 months, and we need to prioritise those integration hooks.”

The case for automated collection

Gary Paragpuri, chief executive of Hub and Spoke Innovations, says the company is fast approaching its 100th Pharmaself24 installation. The company has also started working with hospitals as it looks to create bespoke collection units that serve niche patient groups.

“Two models are offered currently – a smaller Entry and larger Multi version – but we will shortly be expanding our range with an even smaller Compact model, which is currently being tested in locations across Europe,” says Paragpuri.

At the end of last year the Welsh Government announced grant funding to support a small number of pharmacies to install prescription collection units. “We’ve just installed the first of those in an independent pharmacy in Cardiff, with quite a few more scheduled to go live before the Government’s end of March deadline,” he reports.

So what benefits does this form of automation offer? The case study that follows gives some pointers. Although a fictional scenario, the data and findings are drawn from the real experiences of Pharmaself24 customers.

Looking for a competitive edge Meet Anne Verage. She owns a typical community pharmacy dispensing around 12,000 items per month in a medium- sized town in England.

The pharmacy is open from 8am to 6pm Monday to Friday and a half-day on Saturday. It enjoys a good reputation locally, but it faces challenges. Anne’s OTC business has long been lost to local supermarkets, while funding pressures, internet pharmacies and entrepreneurial local competitors are slowly chipping away at her dispensing income.

Local competition comes primarily from two multiples, both of which are rolling out new central dispensing hubs to support their branches, and an independent that has built up a large home delivery service. As the pharmacy furthest from the town’s largest GP surgery, Anne needs something to give her a competitive edge.

After completing an audit of her business and researching what other contractors are doing, Anne creates a three-year plan. She wants to offer something different to her competitors as a way to secure the loyalty of existing customers and, ideally, attract new business.

With this is mind, she launches an app to enable patients to order repeats and installs a Pharmaself24 for 24/7 medicine collection. Anne’s team were tasked with signing up the pharmacy’s existing customers to the app and 24/7 collection service, while social media advertising was used to market the service to all other patients in the town.

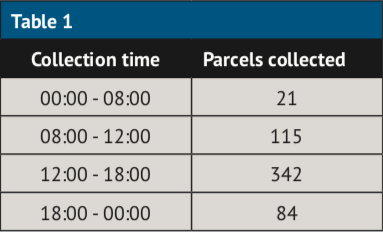

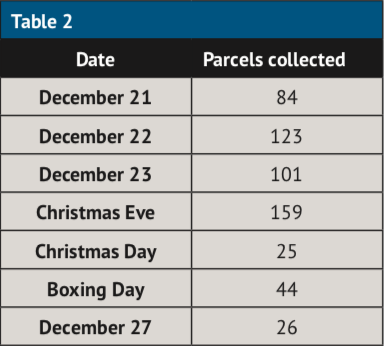

Some six months later, just over 500 patients collect their medicines from Anne’s PS24 each week – that’s over 2,100 patients every month. As Table 1 shows, during Christmas week at least 105 collections were made outside of the pharmacy’s opening hours. A total of 25 collections were even made on Christmas Day itself (see Table 2).

Over time, collection data has given Anne a deeper insight into how the Pharmaself24 is being used. Mornings are when patients with exempt prescriptions tend to collect their medicines, while patients who pay prefer to collect later in the day or when the pharmacy is closed. As well as helping her team prioritise which scripts to dispense first, the data helps Anne plan the best time of day to roll out specific services for these patient groups.

She estimates that each collection made from the unit frees up around two to three minutes of staff time on average. With around 500 collections per week this amounts to between 16-25 hours of staff capacity each week – time that can be spent supporting patient recruitment and on administration associated with the new services she’s planning.

This estimated time saving, plus a significant reduction in both queues and interruptions from patients coming in earlier than expected to see if their medicines are ready, means the pharmacy now closes for lunch, providing an opportunity for staff development and internal meetings.

Tables 1 and 2 show actual Pharmaself24 collection data from a pharmacy that dispenses 12,000-13,000 items per month

If at first you don’t succeed...

The Medicines and Medical Devices Bill, which received Royal Assent on February 11, gives the Government scope to introduce secondary legislation allowing hub and spoke dispensing to be introduced “across legal entities”. At present, of course, it may only be used within a single organisation.

Pharmacy minister Jo Churchill has said a consultation will take place first. Following that “the Government will report to Parliament and include a summary of the concerns raised... To ensure that we get the right model to assist pharmacy going forward, we intend to be totally transparent.”

The Department of Health still seems wedded to hub and spoke as a preferred option to drive down pharmacies’ costs, and the larger multiples have already invested considerable sums in such operations. However, this route has always looked less attractive for independents and smaller companies. The cost-benefits are being increasingly questioned, and legal issues around data transfer, stockholding and liability for any picking errors have to be addressed.

Legalities aside, how do the economics of having an automated dispensing system in-house compare to using a hub? There isn’t a simple answer to that question, says Joshua Akin-George, sales leader – Northern Europe, for BD Rowa Technologies. Automation continues to become more affordable with reduced timescales for return on investment, he says, but a raft of other factors needs to be considered when comparing ‘going it alone’ with buying into or setting up a hub and spoke service.

“It depends on factors such as size of the group, the existing infrastructure that you have in place to enable deliveries, and proximity to the hub of the premises to be served. All these need to be evaluated against the goals you are trying to achieve and the costings,” he says.

Like others, BD Rowa has been looking at scenarios that may emerge from the hub and spoke consultation. “We are seeing greater interest in smaller hubs which serve five to 10 local pharmacies that enable a faster response in the event of issues arising and quicker resolution of the problem. There will be larger groups, I’m sure, that will look to take advantage of their infrastructure and economies of scale,” says Akin-George.

BD Rowa has over 300 installations in pharmacies in the UK and Ireland, and continues to see strong demand mainly from independent pharmacies and small to medium sized independent multiple groups, Akin-George reports.

He predicts an increased uptake of automated robots in the future. At the moment Government support for businesses offers a once-in-a-lifetime opportunity, he says. Low interest rate loans, such as CBILS, can be used to invest now in automation to ensure the ongoing sustainability of a business.

Joshua Akin-George argues that the pandemic has made the need to automate pharmacies even more relevant. “The effectiveness of being supported by a robot has proven itself. Pharmacists have been able to continue to dispense medication effectively and accurately. They have been able to increase their volume of dispensed medication in line with the increased demand. It has allowed workflows to adapt by supporting distancing for pharmacy staff and in many cases enable the operations to continue with fewer staff.”

Cegedim links with MED e-care

MED e-care and Cegedim have formed a new partnership to integrate Cegedim’s Pharmacy Manager with MED e-care’s electronic Medication Administration Record (eMAR) to ensure “seamless medication dispensing between pharmacies and care homes”.

“Particularly in today’s environment, with the health and safety of care home residents in the spotlight, it is imperative that our solutions combine to create a seamless, flexible, electronic health record that reflects the needs of residents, nurses and carers,” says Chris Pearson, head of care partnerships at MED e-care.

From dispensing monthly medications to daily interim orders, all communication from the pharmacy is sent directly to the eMAR system to ensure safe, secure and auditable transmission of information, negating the need for rekeying, saving time and ensuring medication accuracy. From a pharmacist’s perspective, the integration will enable enhanced service levels for care homes and care home residents, such as regular medication reviews and medicines management services, say the two companies.

Omnicell looks to community

Omnicell has historically focused on the hospital environment. Cyrus Hodivala, the company’s medicines adherence sales director for UK and Ireland, claims that every open tender in the hospital market over the past two to three years has seen Omnicell replace the existing incumbent.

While admitting that the company has had some poor experiences in the past with getting PMR suppliers to develop interfaces, he says Omnicell is turning its attention to the community sector.

“We have nine RDS systems (full pack picking robots) in the retail sector but 50 in hospitals. We see the retail sector as a major growth opportunity. We reckon there are about 700 robots installed in UK community pharmacies. You can assume a 10-year life span. That means we could expect 70 inquiries a year just to renew equipment. We expect it to be two to three times that.”

Hodivala says the company hardly did any business in the first half of 2020, but after July inquiry levels went through the roof. “Many independents were seeing a surge in dispensing volumes. There have been massive staffing issues during the pandemic. Reliance on manual operations has been hard – and is now recognised as a huge risk.”

Omnicell describes its new Medimat as “the future of retail automated dispensing”. An input speed of 750 packs an hour is claimed to be one of the fastest available, with patented suction pads ensuring boxes and bottles are not damaged during the dispensing process.

The new model has a greater pack capacity than its predecessor and is available with up to 10m of conveyor belt. Flexible shelving gives the ability to manage larger pack dimensions, increasing the number of lines that can be automated. The system is available in bespoke sizes and configurations suitable for any pharmacy, says the company.

Size is a concern for many pharmacies when it comes to installing a robot. The smallest Omnicell offers is 3.75m long by 1.65m wide and 1.65m high, but you get a better outcome if you can go to 5m long and 2m high, says Hodivala. “We have a 3D modelling tool that allows us to show pharmacists what an installation will look like.”

While its robots have, in the past, come with a high degree of customisation, some standardisation is now being introduced. The company can offer units up to 6.5m in 25cm increments, but has created six standard heights. “That means we can offer some compelling price points,” he says.

Omnicell also offers a MDS option with its VBM blister card packaging machine. With a small footprint it can pack up to 40 sealed blister cards an hour. Linked to its eMAR system and using real time data, it aims to improve patient safety and foster cohesion between pharmacy and care homes. Each card has a unique code recognised by the eMAR, meaning MDS cards shipped to a care home can be checked in with a single scan.

“Filling MDS manually poses a risk, but once you get to a large number of patients it can become unmanageable. Robotic assembly allows you to do it accurately,” says Hodivala. Using MDS in a care home in London reduced the duration of the medicines round from two hours to 26 minutes, he adds.

NHS on a digital roll...

Digital services provided by the NHS saw a huge increase in usage throughout 2020 as a result of social distancing and the need to access healthcare remotely.

The NHS website is one of the biggest health-related websites in the world. It usually attracts around 360 million visits a year but this rocketed to an estimated 803 million visits since the pandemic started.

The NHS App allows people to access a range of NHS services on their smartphone or tablet – from ordering repeat prescriptions to booking and cancelling GP appointments. In December 2019, there were 192,676 people using the app. A year on this figure had increased by 912 per cent to 1,951,640 users.

The number of repeat prescription requests made via the app increased by 495 per cent – from 45,931 in January 2020 to 273,351 in November 2020, and the number of patient record views rose by 321 per cent – from 258,404 in January 2020 to 1,089,615 in November 2020.